Michalis Sarris, Former Finance Minister and Chairman of Laiki Bank at Center of Controversy

**********

Did His Arrest in Turkish-Occupied Cyprus For Sex Crimes With a 17 Year Old Boy Play Any Part in the Banking Crises?

Michalis Sarris was a big man in the banking world. He was a former governor of the Central Bank, Cypriot Finance Minister from 2005 to 2008, and Chairman of the Laiki Bank, the bank that is now being torn apart by the EU. He was a graduate of the London School of Economics and held a position at the World Bank.

The strange ordeal of Mr. Sarris begins on October 14, 2011, when he was arrested, along with one of his employees, at a house in Nicosea, Turkish Occupied Cyprus. Sarris, then 65, was found naked and accused of having unnatural sexual relations with a minor, a 17 year old Turkish settler. The claims of Mr. Sarris, who said he was getting a 20 euro “massage” didn’t fly with the Turkish police, who arrested all three, Sarris, his employee, and the minor. After a short stint in jail, Sarris posted a huge 50,000 euro bond and returned to the Greek part of Cyprus. He later skipped showing up for his trial at a Turkish court and forfeited the bond. One wag said that the 2011 massage cost Sarris 50,020 euros, the most expensive massage in the history of Cyprus.

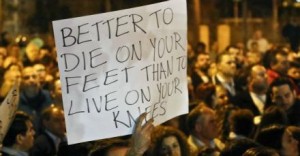

Shortly after his arrest, he was appointed Chairman of the Laiki Bank, and it was in this position that he negotiated with the Troika of Doom, The EU, The International Monetary Fund, and the European Central Bank. This is the power trio that forced Cypriot President Nikos Anastasaides to sign an agreement that surrendered the depositors’ funds to the EU. The Cypriot Parliament did not vote on this, and some legal experts question the legality of the agreement that put possibly millions of depoitors at risk. With the forced collapse of the Laiki Bank, Sarris was appointed by President Anastasaides to be Finance Minister of Cyprus once again in February 2013.

Mr. Sarris did not remain long as Finance Minister. He Resigned on April 2,

2013. After his resignation, he decided to “set the record straight” about his negotiations with the Troika. Sarris claims that the deal he made was for the depositors to only take a 21/2% “haircut” on interest, and further, in order to avoid a run on the banks, that if any deposits dropped down to 70%, than a tax of 2 1/2 percent would be put on interest received on the account, not the principal. This 2 1/2% on interest is a long way from the 77.5% the Troika is now seizing from the accounts of customers of Laiki Bank and The Bank of Cyprus who have over 100,000 euros on deposit. This recent information on the secret negotiations brings to mind several questions. Did the Troika “double-cross” Mr. Sarris, leading him to believe that the so-called “haircut” would only be on interest, then slamming a different deal by surprise on President Anastasiades? Or did Mr. Sarris know all along about the huge bite that was going to be taken out of his bank’s customers? Did Mr. Sarris throw his own customers to the wolves of the Troika? Did the Troika, or any of their operatives, have even more secret information about Mr. Sarris’ homosexual life-style and threaten to reveal it and ruin him if he didn’t “play ball”? It would not be the first time in history that sexual blackmail had taken place. Or is Mr. Sarris telling the truth, revealing the Troika to have negotiated in bad faith, with a hidden agenda, and were planning to blindside Mr. Sarris all along? These and other questions should be investigated by the Cypriot government if they want to get to the bottom of this morass.